The Impact of Geopolitical Risk on International Investments

When we think of investing internationally, the goal is often to find opportunities in growing markets and diversify our portfolios. However, there's a key factor that can influence the success or failure of those investments: geopolitical risk. In this blog post, we'll explore what geopolitical risk is, how it impacts international investments, and what you can do to protect your money from unexpected events.

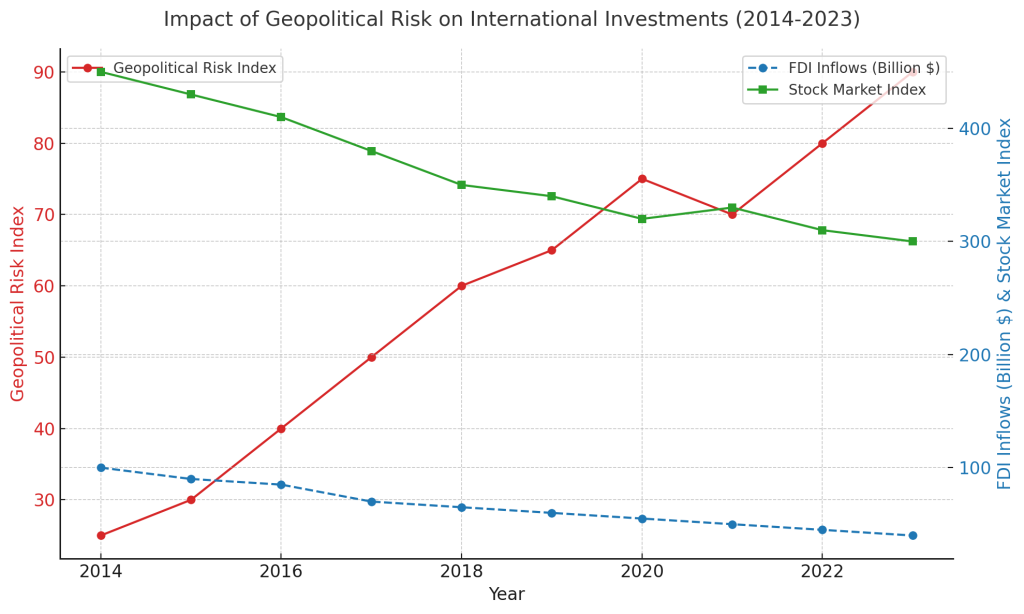

Geopolitical risk refers to the influence of political events—like wars, elections, international trade conflicts, or government policies—on markets and economies. These events can create instability, uncertainty, and volatility in financial markets across the world. For example, a trade war between two major countries like the U.S. and China can disrupt global supply chains, leading to changes in the prices of goods and the value of currencies. Similarly, military conflicts or political sanctions can affect oil prices, stock markets, and business operations in affected regions.

How Does Geopolitical Risk Affect International Investments?

- Stock Market Volatility

Geopolitical events can make stock markets unstable. When there is uncertainty due to political issues, investors tend to sell off risky assets, causing market drops. This reaction is common in situations like military conflicts or political crises, which can cause sudden and significant losses in international stock markets. - Currency Value Changes

Political events can also lead to fluctuations in a country’s currency. For example, if a country faces sanctions or political unrest, its currency may lose value. For international investors, this means the value of their investments in that country could decrease, even if the underlying business is still doing well. - Commodity Price Swings

Many geopolitical risks impact commodity prices, especially oil and gas. For example, conflicts in the Middle East, a key oil-producing region, can lead to spikes in oil prices, which affects not only the energy market but also global transportation costs and industries reliant on oil. - Government Policies and Trade Wars

Sometimes, geopolitical risks come from changing trade policies. Governments may impose tariffs or sanctions that make it more expensive to do business in certain countries. For investors, this can mean lower profits for companies operating in those regions or disruptions in international supply chains.

Real-Life Examples

- Brexit: When the United Kingdom voted to leave the European Union (EU), global markets reacted with uncertainty. The British pound lost value, and companies with ties to the UK and EU had to rethink their strategies. Investors in both regions saw significant impacts on their portfolios.

- Russia-Ukraine Conflict: The war between Russia and Ukraine had widespread effects on international investments. Oil and gas prices surged, European markets experienced volatility, and sanctions imposed on Russia impacted global trade, leading to financial uncertainty for investors with exposure in those regions.

What Can Investors Do to Manage Geopolitical Risk?

While no one can predict when or where the next geopolitical crisis will occur, there are steps investors can take to reduce the risk to their portfolios.

- Diversify

One of the most effective ways to reduce risk is by diversifying your investments. By spreading your money across different countries, industries, and asset classes, you can lessen the impact of any one event on your entire portfolio. If a crisis hits one region, your other investments can help balance the potential loss. - Keep an Eye on Global News

Staying informed about global events is key. Geopolitical tensions often build over time, and being aware of potential risks can help you make informed decisions about your investments. - Invest in Stable Economies

Some economies and currencies, like the U.S. dollar or Swiss franc, are considered “safe havens” during times of geopolitical instability. Including investments in these stable regions can help protect your portfolio during times of uncertainty. - Consider Safe-Haven Assets

Certain assets, like gold or government bonds, tend to perform well when geopolitical risks rise. Adding these to your portfolio can offer protection in times of global tension.

Conclusion

Geopolitical risks are an inevitable part of international investing, but that doesn’t mean they should be avoided altogether. By understanding these risks and taking steps to manage them, you can protect your portfolio from unexpected events and continue to benefit from the growth potential of international markets. Whether you’re investing in stocks, bonds, or commodities from around the world, keeping an eye on global politics is just as important as watching market trends.